Car title loans Sherman TX provide secured lending options using vehicles as collateral, offering flexible repayment terms and quick access to cash based on vehicle value (50%-100%). With transparent interest rates influenced by vehicle value, credit history, loan amount, and payment options, these loans cater to diverse financial needs, including those with poor credit, offering a reliable solution during challenging times.

“Unraveling the mysteries of car title loans in Sherman, TX, is crucial for anyone seeking quick cash solutions. This article aims to guide you through the process, starting with an overview of these unique loans and their appeal. We’ll then delve into the mechanics behind interest rates on Sherman TX car title loans, explaining how they work. Furthermore, we’ll explore the key factors that influence these rates, empowering borrowers to make informed decisions in the vibrant, fast-paced lending landscape of Sherman, TX.”

- What Are Car Title Loans?

- How Do Rates Work on Sherman TX Car Title Loans?

- Factors Influencing Interest Rates for Car Title Loans in Sherman TX

What Are Car Title Loans?

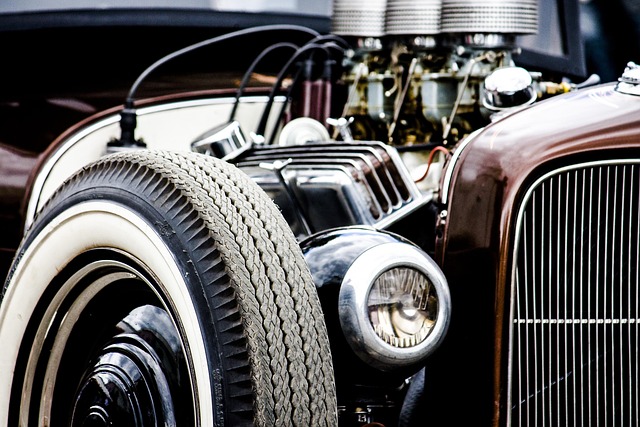

Car title loans Sherman TX are a type of secured loan where an individual’s vehicle serves as collateral for the borrowed amount. This means that the lender has the legal right to take possession of the vehicle if the borrower fails to repay the loan according to the agreed-upon terms. Such loans are often considered a quick and convenient financial solution for those in need of immediate cash, especially since they typically have simpler requirements compared to traditional bank loans.

In this arrangement, borrowers receive funds based on their vehicle’s value, with the amount usually ranging from 50% to 100% of the car’s market value. One significant advantage of Car title loans Sherman TX is the flexibility in repayment terms. Lenders often accommodate borrowers by allowing them to make flexible payments over a more extended period, making it easier for individuals to manage their finances and get back on track without the added stress of a short-term loan. This feature makes vehicle collateral loans an attractive financial option when one needs a reliable and accessible solution.

How Do Rates Work on Sherman TX Car Title Loans?

Car title loans Sherman TX operate on a straightforward principle: the interest rate is determined by the loan amount and the term of repayment. Lenders assess the value of your vehicle, establish a loan-to-value ratio, and set a corresponding interest rate. This ensures that the lender’s risk is mitigated, providing borrowers with a clear understanding of their financial obligation. The rates can vary widely among lenders, so it’s crucial to compare offers from multiple providers.

One notable advantage of car title loans Sherman TX is the flexibility in repayment terms. Many lenders offer flexible payment plans tailored to individual borrower needs, including the option for direct deposit. This allows borrowers to spread out their payments over an extended period, making the loan more manageable. Moreover, with no credit check required, these loans are accessible to a broader range of individuals, offering a solution for those who may not qualify for traditional loan options.

Factors Influencing Interest Rates for Car Title Loans in Sherman TX

The interest rates for car title loans Sherman TX are influenced by several factors, all of which play a crucial role in determining the overall cost of borrowing. One significant factor is the market value of your vehicle; higher-value cars typically come with lower interest rates since they offer lenders more security. Additionally, your credit history and credit score are essential considerations. Lenders assess your creditworthiness to decide on the rate; a strong credit profile usually results in better terms.

Another critical aspect is the loan amount requested. Smaller car title loans Sherman TX may have higher interest rates compared to larger sums since lenders perceive lower risks with bigger loans. Furthermore, flexible payments and repayment options can impact these rates. Bad credit loans, for instance, might come with slightly higher charges to compensate for the increased risk taken by the lender.

Car title loans Sherman TX offer a clear and competitive lending solution, with interest rates determined by various factors unique to each borrower. By understanding how these rates work, you can make informed decisions regarding your financial needs. Whether it’s for an emergency or a planned expense, Sherman TX car title loans provide access to capital, allowing you to leverage the value of your vehicle. Remember, transparency and knowledge are key when considering any loan, ensuring you get the best terms possible for your situation.