Car title loans Sherman TX offer quick cash access for individuals with good vehicle equity, but they come with high-interest rates, fees, and repossession risks. While they have lenient eligibility requirements compared to traditional banking, these loans can significantly impact future borrowing opportunities due to their stringent repayment terms. Borrowers in Fort Worth are advised to explore safer financial solutions before considering this risky alternative.

“Navigating the world of car title loans in Sherman TX can be a tricky path, filled with potential pitfalls for the uninformed. This article serves as your guide, offering insights into the benefits and risks associated with this unique form of lending. By understanding how car title loans work, you can avoid common mistakes like overspending or missing payments. From checking lender credibility to exploring alternatives, we empower you to make informed decisions, ensuring a secure and successful loan experience in Sherman TX.”

- Understanding Sherman TX Car Title Loans: Benefits and Risks

- – Definition of car title loans

- – How they work in Sherman TX

Understanding Sherman TX Car Title Loans: Benefits and Risks

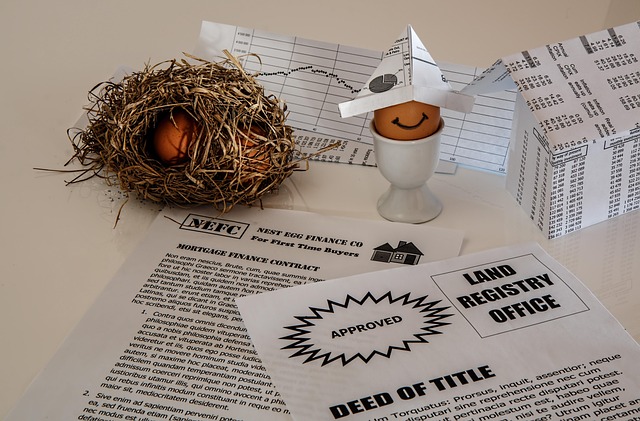

Car title loans Sherman TX have gained popularity as a rapid source of emergency funding for individuals facing financial difficulties. These loans are secured by the vehicle ownership, which means the lender has the right to repossess the car if the borrower fails to make payments. Despite this risk, many people in Fort Worth Loans opt for car title loans due to their potential benefits. Accessing these funds can be quicker and more straightforward than traditional bank loans, as it involves less stringent eligibility requirements and a shorter application process.

However, understanding both the advantages and drawbacks is crucial. While car title loans Sherman TX can offer fast access to capital, they often come with high-interest rates and fees, potentially making them a costly option for emergency funding. Additionally, there’s a risk of losing Vehicle Ownership if you’re unable to repay the loan on time. Therefore, borrowers should carefully consider their financial situation and explore alternative options, such as personal loans or seeking assistance from local community resources, before opting for this type of secured lending.

– Definition of car title loans

Car title loans Sherman TX are a type of secured lending where borrowers use their vehicle’s registration and title as collateral to secure a loan. This alternative financing option is popular among individuals who need fast cash and have a car with significant equity. Unlike traditional loans that rely on credit scores, car title loans offer easier approval criteria, making them accessible to more people. Borrowers essentially transfer the ownership of their vehicle to the lender until the loan is repaid, including interest.

This unique arrangement allows for quicker loan approval processes, often within a day or less, and can result in higher borrowing limits compared to typical personal loans. The simplicity and speed of car title loans Sherman TX make them an attractive solution for those seeking fast cash, especially when facing unexpected expenses or financial emergencies. However, borrowers must be mindful of the potential risks, such as late payment fees and the possibility of repossession if they fail to meet repayment terms, which could impact their ability to access future Loan Payoff opportunities.

– How they work in Sherman TX

In Sherman TX, car title loans operate as a form of secured lending where individuals use their vehicle’s equity as collateral. This type of loan is designed for those who need quick access to cash and may not have ideal credit scores. The process involves providing the lender with your vehicle’s title, which they hold until the loan is repaid. Repayment typically involves making flexible payments over a set period, allowing borrowers to maintain their daily use of the vehicle while repaying the loan.

Car title loans Sherman TX offer an alternative financing solution by leveraging the value of your vehicle. This can be particularly beneficial for those in need of immediate funds and who may struggle with traditional loan applications due to credit constraints or other financial challenges. The flexibility in payments ensures that borrowers can manage their repayments according to their financial capabilities, making it a viable option for short-term financial needs.

When considering car title loans Sherman TX, it’s crucial to balance the potential benefits with the associated risks. By understanding how these loans operate and their impact on your financial health, you can make an informed decision that best suits your needs. Always remember to explore all options and seek professional advice before committing to any loan agreement.