Car title loans Sherman TX offer quick cash access using your vehicle as collateral, but come with high interest rates and repossession risks if not repaid on time. When choosing a lender, prioritize transparency, flexible terms, and excellent customer service to avoid hidden fees. Reputable lenders like Ace Title Loans and Auto Cash Express in Sherman TX provide competitive rates, straightforward applications, and diverse loan options for borrowers with poor credit or financial constraints.

Looking for fast cash in Sherman, Texas? Car title loans could be an option. Unlike traditional loans, these are secured by your vehicle’s title, offering potential access to higher loan amounts and faster approval times. This article guides you through understanding car title loans in Sherman TX and highlights key factors to consider when choosing a lender. We also feature top-rated lenders for convenient comparison, helping you make an informed decision about your financial needs.

- Understanding Car Title Loans Sherman TX: How They Work

- Key Factors to Consider When Choosing a Lender

- Top-Rated Lenders for Car Title Loans in Sherman TX

Understanding Car Title Loans Sherman TX: How They Work

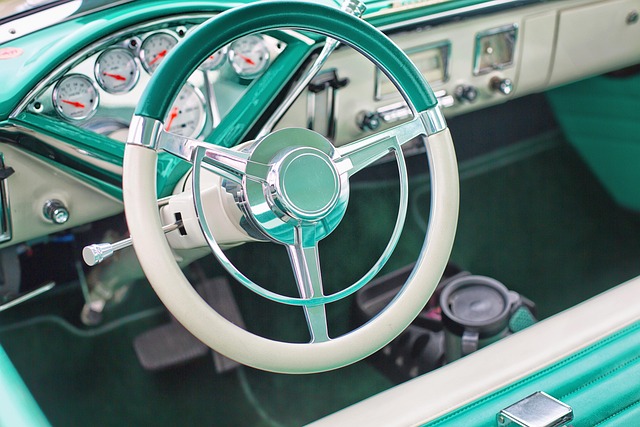

Car title loans Sherman TX are a type of secured lending that uses an individual’s vehicle—typically their car—as collateral. This alternative financing option is designed for borrowers who need quick access to cash and may not qualify for traditional bank loans due to poor credit or other financial constraints. Here’s how they work: a lender assesses the value of your vehicle, determines a loan amount based on that value, and then provides you with funds. The title of your vehicle is transferred temporarily to the lender as security for the loan.

Unlike personal loans or credit cards, Car title loans Sherman TX offer higher borrowing limits because the vehicle serves as collateral. However, it’s crucial to understand the loan requirements—such as proving valid vehicle ownership and a clear title, having a steady income source, and maintaining insurance on the vehicle—to ensure a smooth borrowing process. Additionally, borrowers should be aware of potential risks, including interest rates that can be higher than traditional loans and the possibility of repossession if they fail to repay the loan according to the agreed terms. For those with bad credit or looking for Bad Credit Loans, this option might seem appealing, but it’s essential to weigh all factors before deciding on a lender and understanding the Vehicle Ownership requirements.

Key Factors to Consider When Choosing a Lender

When choosing a lender for Car Title Loans Sherman TX, several key factors come into play. Firstly, transparency and honesty are paramount. Reputable lenders will clearly outline their loan terms, interest rates, and any associated fees, ensuring you understand exactly what you’re agreeing to. This is crucial in preventing unexpected charges that can often crop up with less trustworthy providers.

Another important consideration is the lender’s flexibility and customer service. Look for a financial solution that accommodates your needs, whether that means offering adaptable loan terms or providing prompt direct deposit of funds once approved. A good lender should be responsive to your queries and able to guide you through the process, ensuring a smooth and stress-free experience from start to finish.

Top-Rated Lenders for Car Title Loans in Sherman TX

When it comes to top-rated lenders for car title loans in Sherman TX, there are several options that stand out due to their excellent reputation and customer service. These lenders understand the urgency behind cash needs and offer flexible loan terms tailored to suit various borrower profiles. Among them, Ace Title Loans and Auto Cash Express have consistently been favored by locals, thanks to their straightforward application processes and competitive interest rates.

Both lenders provide convenient payment plans that align with your budget, ensuring a hassle-free experience throughout the loan period. In addition to these benefits, they prioritize transparency in their loan terms, allowing borrowers to make informed decisions without hidden fees or complex stipulations. Whether you need a quick cash advance or prefer extended repayment options, these top-rated car title lenders in Sherman TX have got you covered.

When considering car title loans Sherman TX, it’s crucial to weigh factors like interest rates, loan terms, and customer reviews. By understanding how these loans work and evaluating lenders based on key metrics, you can make an informed decision that best suits your financial needs. Remember, a responsible lender will offer transparent terms and fair practices, helping you navigate this option with confidence.