Comparing lenders and rates for Car Title Loans Sherman TX is key to saving money. Examine loan terms, conditions, and collateral policies to find reputable lenders with competitive rates. Balancing lower interest costs with asset risk through responsible repayment can save on expenses compared to other loans. Timely payments reduce fees and improve terms, while a strong payment history secures better Car Title Loan Sherman TX conditions.

Looking to secure a car title loan in Sherman, TX? Saving on interest is crucial. This guide offers practical tips tailored for Sherman residents. First, compare rates and lenders to find the lowest interest rates available. Second, leverage collateral wisely by using your vehicle as security to reduce borrowing costs. Lastly, make timely payments to avoid penalties and save significant money over time. By following these strategies, you can navigate car title loans in Sherman TX more affordably.

- Compare Rates and Lenders for Lower Interest

- Use Collateral Wisely to Reduce Borrowing Costs

- Make Timely Payments to Avoid Penalties and Save Money

Compare Rates and Lenders for Lower Interest

When considering a Car Title Loan Sherman TX, one of the most effective strategies to save on interest is by thoroughly comparing rates and lenders. Don’t just accept the first offer you receive; take time to explore the market. Different lenders may offer significantly varying interest rates for similar loan amounts. A small difference in annual percentage rate (APR) can translate into substantial savings over the life of your loan, especially with longer repayment periods.

By shopping around and comparing loan approval processes, terms, and conditions, you can identify reputable lenders offering competitive rates. Keep in mind that the lender you choose should not only provide favorable interest rates but also have a clear and transparent title pawn process. Ensure they hold your vehicle’s title as collateral, providing you with the security of knowing your asset is protected. This comparison approach will empower you to secure the best deal possible on your Car Title Loan Sherman TX.

Use Collateral Wisely to Reduce Borrowing Costs

When considering a Car Title Loan Sherman TX, one effective strategy to reduce interest costs is to use collateral wisely. This means leveraging assets that are readily available and valuable, such as your vehicle. Securing your loan with your car allows lenders to mitigate risk, often resulting in lower interest rates compared to other types of personal loans. By choosing a Car Title Loan over alternatives like Semi Truck Loans or relying solely on Emergency Funding, you can potentially save significant money in the long run by paying off the loan faster and with less interest accrued.

Additionally, using collateral can simplify the loan process, as the lender has a clear path to repayment if you default. This can lead to better terms and conditions, including lower borrowing costs. It’s important to weigh these benefits against the risk of losing your asset if you’re unable to repay, but with responsible financial management, leveraging collateral for a Car Title Loan Sherman TX could be a smart move to save on interest expenses.

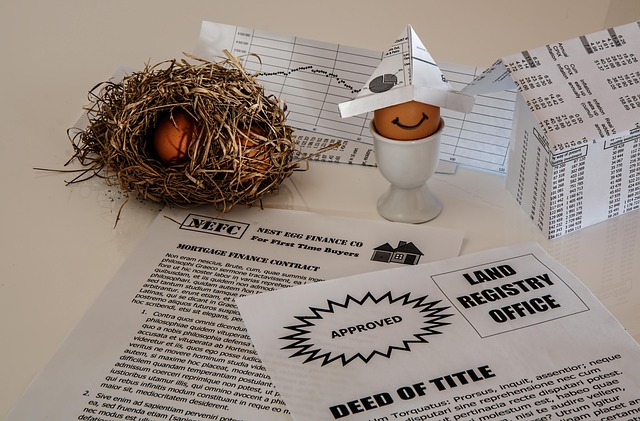

Make Timely Payments to Avoid Penalties and Save Money

Making timely payments is a crucial strategy to save on interest for your Car Title Loans Sherman TX. Many lenders charge penalties and additional fees if payments are late, so adhering to the due dates can significantly reduce your overall borrowing cost. By ensuring prompt repayment, you avoid these charges and potentially lower your interest rate over time.

This approach not only helps you manage your budget effectively but also demonstrates a commitment to repaying your loan responsibly. Many lenders appreciate timely payments and may be more inclined to offer better terms in the future, including reduced interest rates or even waiving certain fees, especially if you opt for automatic payments through their online platforms. Remember that when it comes to Car Title Loans Sherman TX, maintaining a good payment history is key to saving money.

When considering a car title loan in Sherman, TX, implementing these strategies can significantly reduce your interest expenses. By meticulously comparing rates and lenders, utilizing collateral efficiently, and consistently making timely payments, you can save substantial amounts on interest over the life of your loan. Remember that responsible borrowing and proactive financial management are key to getting the best deals on car title loans Sherman TX has to offer.