Car title loans Sherman TX provide rapid cash access using vehicle titles as collateral, suitable for those with less-than-ideal credit or no history. After meeting basic criteria (income proof, ID, clear title), lenders assess vehicle value to determine loan amounts, allowing borrowers to retain their vehicle throughout repayment. Responsible borrowing involves evaluating financial health, understanding terms & fees, choosing reputable lenders, and comparing offers.

Considering a car title loan in Sherman, TX? It’s crucial to understand these secured loans’ benefits and risks before borrowing. This guide breaks down the basics of car title loans, clarifies who qualifies, and offers essential tips for responsible borrowing. By understanding the process and adhering to precautions, you can make an informed decision about your financial needs in Sherman, TX.

- Understanding Car Title Loans: Basics and Benefits

- Eligibility Criteria: Who Qualifies for Sherman TX Car Title Loans?

- Responsible Borrowing: Tips and Precautions for Borrowers

Understanding Car Title Loans: Basics and Benefits

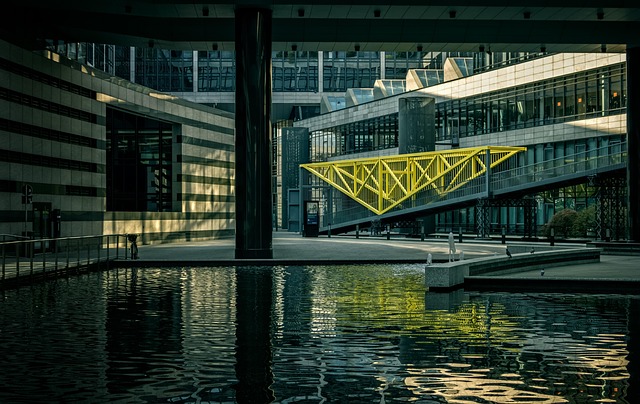

Car title loans Sherman TX are a type of secured lending where individuals use their vehicle’s title as collateral to secure a loan. This alternative financing option is designed for borrowers who need quick access to cash and may not qualify for traditional bank loans. The process involves allowing a lender to place a lien on the vehicle until the loan is repaid, with repayment typically structured as monthly payments over a set period.

One of the key benefits of Car title loans Sherman TX is their accessibility. Unlike Houston Title Loans or Fort Worth Loans, which often require stringent credit checks, these loans focus primarily on the value and condition of the vehicle. This makes them an attractive option for those with less-than-perfect credit or no credit history, providing a means to access emergency funds or fund essential purchases without the usual barriers. Additionally, the approval process is usually faster than traditional loan methods, making it a convenient solution for immediate financial needs.

Eligibility Criteria: Who Qualifies for Sherman TX Car Title Loans?

Car title loans Sherman TX are a financial solution designed for individuals who own a vehicle and need quick cash. To qualify, borrowers must meet specific eligibility criteria. Typically, lenders require proof of income to ensure the borrower has the means to repay the loan. A valid government-issued ID and a clear vehicle title, free from any liens or existing loans, are also essential. Lenders assess the value of the vehicle to determine the maximum loan amount offered.

One key advantage of car title loans Sherman TX is that they allow borrowers to keep their vehicle as collateral, ensuring they retain ownership during the repayment period. Repayment options can be tailored to fit individual needs, offering flexibility in terms of schedule and amount. This can be particularly beneficial for those looking to debt consolidation, providing a more manageable way to pay off multiple debts with a single, lower interest rate loan.

Responsible Borrowing: Tips and Precautions for Borrowers

When considering Car title loans Sherman TX, it’s crucial to adopt responsible borrowing practices to ensure a positive experience. Before applying, borrowers should assess their financial situation and determine if this type of loan aligns with their long-term goals. A thorough understanding of the loan process is essential; this includes knowing the interest rates, repayment terms, and potential fees associated with Car title loans Sherman TX. Lenders should be chosen carefully, prioritizing reputable companies that offer transparent terms.

One common use case for these loans is debt consolidation. However, borrowers must ensure they can comfortably afford the higher monthly payments without falling into a cycle of debt. Comparing offers from different lenders and exploring alternative financing options like Dallas Title Loans or traditional banks can help individuals make informed decisions. Additionally, maintaining open lines of communication with lenders about any concerns or changes in financial circumstances is vital for successful borrowing.

When considering car title loans in Sherman, TX, responsible borrowing is key. By understanding the basics, eligibility criteria, and taking precautions, you can make an informed decision that aligns with your financial goals. Remember, while car title loans offer benefits, they come with risks, so always weigh your options and choose a lender that prioritizes your best interests.