Car title loans Sherman TX offer quick cash secured by a vehicle's title, with less stringent requirements than traditional bank loans. The process involves submitting paperwork, inspection, and a credit check. Repayments are typically fixed, and non-compliance can lead to repossession. Borrowers must be aware of hidden fees and thoroughly research lenders, understanding upfront costs, interest rates, and repayment terms before signing. Opting for loan refinancing mid-term is possible but prioritizing transparency is crucial.

“In the financial landscape of Sherman, Texas, understanding car title loans is essential for residents seeking quick cash solutions. This comprehensive guide aims to demystify car title loans, highlighting their benefits and potential pitfalls. We delve into ‘Unveiling Hidden Fees,’ equipping you with knowledge before securing a loan. Learn how to navigate the process safely and transparently, ensuring you make informed decisions about your vehicle’s equity. Explore the options for car title loans Sherman TX residents trust.”

- Understanding Car Title Loans: A Comprehensive Guide for Sherman TX Residents

- Unveiling Hidden Fees: What You Need to Know Before Taking Out a Loan

- Navigating the Process: Securing a Safe and Transparent Car Title Loan in Sherman TX

Understanding Car Title Loans: A Comprehensive Guide for Sherman TX Residents

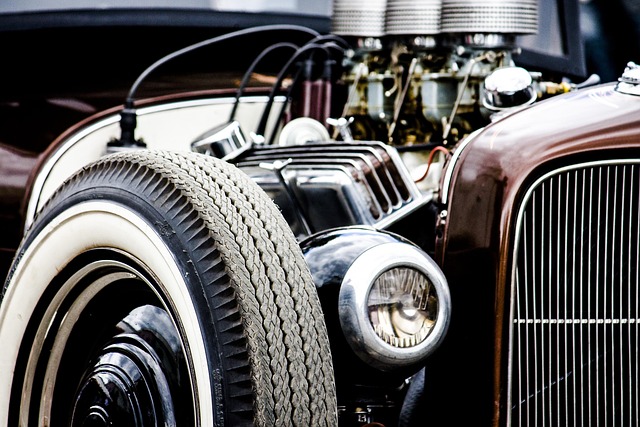

Car title loans Sherman TX are a type of secured lending where individuals use their vehicle’s title as collateral to secure a loan. This option is popular among those needing quick cash, often with less stringent requirements compared to traditional bank loans. Unlike typical loans that rely on credit scores, car title loans assess the value of your vehicle, making them accessible even to those with poor or no credit history.

The process typically involves providing the lender with your vehicle’s registration and title, undergoing a brief vehicle inspection to determine its worth, and successfully passing a credit check. Upon approval, you’ll receive a lump sum, and you’ll be responsible for making regular payments, usually over a fixed period. One key aspect is that if you fail to make repayments as agreed, the lender may repossess your vehicle. Additionally, some lenders offer the option of a loan extension, allowing borrowers more time to repay, but this comes with associated fees.

Unveiling Hidden Fees: What You Need to Know Before Taking Out a Loan

When considering a Car Title Loan Sherman TX, it’s crucial to stay vigilant against hidden fees that can significantly increase your financial burden. Many lenders attempt to obscure these costs within complex terms and conditions, making it essential for borrowers to read every line carefully before signing. Unsuspecting borrowers might find themselves paying extra for services they didn’t even know existed, such as processing fees, early repayment penalties, or documentation charges.

Before taking out a Car Title Loan Sherman TX, conduct thorough research on the lender and be mindful of any upfront costs, interest rates, and repayment terms. Understanding what’s included in the loan package, including potential hidden fees like title pawn services or San Antonio Loans administration charges, can save you substantial amounts of money in the long run. Always ask about any additional costs associated with your vehicle equity loan to ensure complete transparency from the lender.

Navigating the Process: Securing a Safe and Transparent Car Title Loan in Sherman TX

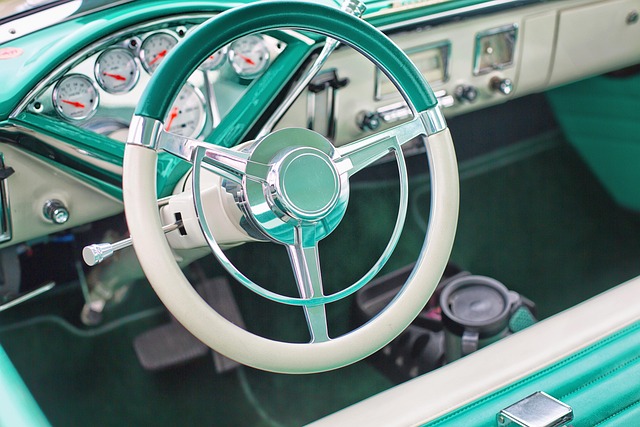

Navigating the process of securing a car title loan in Sherman TX requires careful consideration to avoid hidden fees and ensure transparency. When comparing car title loans Sherman TX, it’s crucial to understand the terms, interest rates, and repayment conditions offered by different lenders. Many reputable lenders provide clear information about their fee structures upfront, making it easier for borrowers to make informed decisions.

One way to safeguard against unexpected charges is to thoroughly review the loan agreement before signing. Pay special attention to details regarding interest calculation methods, late payment fees, and any additional costs associated with bad credit loans or debt consolidation. Some lenders may offer the option of loan refinancing, which could help borrowers secure more favorable terms mid-loan. However, always prioritize understanding the full scope of the loan before opting for such a decision.

When considering car title loans Sherman TX, understanding potential hidden fees is crucial for making an informed decision. By being aware of these costs and opting for transparent lenders, residents can navigate the process with confidence and avoid financial surprises. Remember that a reputable lender should provide clear terms and conditions, ensuring a safe and secure loan experience tailored to your needs.